Optimax provides quality HD video systems and modern IP phone systems。

Optimax systems have been installed in homes, banks, retail stores, hospitals, and restaurants. We minimize our operation costs and pass the savings to you. We guarantee the lowest price on all our services, please call for free estimate.

Please feel free to contact us. Monday - Friday: 7am - 5 pm Pacific Standard Time.

Optimax Enterprise Inc.

9436 La Rosa Dr. Temple City, CA 91780

Tel: 626-297-1344; 626-380-2328

Optimax

Joomla! and Open Source fan. In spare time he writes the blog posts about Joomla Tutorials including reviews of popular Joomla Templates, Extensions and services. If you have started learning Joomla just buzz him via Skype, He would be glad to help you :).

Twitter: http://www.twitter.com/joomlashine Facebook: http://www.facebook.com/joomlashine刚来美国

你把从国内辛苦挣的钱带来美国。手头的余钱该如何善用?

美国的资本市场比中国的稳定, 法制更加的完善。你应考虑投资好的金融产品。

- 找好的理财专业人员, 了解基本的法律保障

- 认识美国的产品

- 建立正确的投资心态- 合法, 去除投机念头。

- 买适度的保险

如果你人还在中年,刚买了房子,将孩子送进理想的学校。 你可能手头的余钱短期内不足以再投资大标的(如: 房子),你这笔钱5-8年内不需动用, 那你应做中期投资。同时投资可以减税的金融产品。

如果你以不打算再继续拼搏,只打算让积蓄稳健安全的成长。 那你应考虑买年金, 长期看护保险, 设立财产信托。开始了解社会福利,联邦医疗保险(红,蓝,白卡)。

如果你是刚在美国找到稳定的工作, 开始每年缴税。你应立即设立可减税的账户, 为未来买房,子女的教育基金准备。

退休生活

美国退休生活

终于退休了!我们开始着眼如何保持足够的老本并过自己想过的生活,同时希望能给子孙留点财产。

62-70岁半 -退休年龄段的注意事项

祝愿此时你有最佳的财富+健康,预备好走更远的路。为你的福利着想,请特别留意一些特别的日子。

62岁生日

在你62岁生日的次一个月,你可以开始领取社会安全保障金。除非你是残障,62岁就领退休金的话,你可领全额退休金的75%。 你的配偶也可以领跟着来的配偶社会福利金。社会局建议申请人在提领日之前3个月就开始办手续。

65岁

在你65岁生日的时候,如果你尚未打算领取社会福利,你应于生日前3个月提出申请可以獲得免費的聯邦醫療保險 Medicare 醫院保險(A 部分)。

任何享有免費聯邦醫療保險住院醫療保險(A 部分)的人都可以通過每月支付保險費參加聯邦醫療保險的門診醫療保險(B 部分)。在首次符合醫院保險(A 部分)的資格時,您有七個月的時間申請醫療保險(B 部分)。申請的延誤將會導致保險開始的延遲,並使保費提高。

如本人或配偶目前正在工作並具有雇主提供的團體的醫療健康保險,您可以推遲申請聯邦醫療保險Medicare 的 B 部分,並不需要支付因延遲投保而加收的罚 款。

66岁

若您在 1943 年至1954 年間出生,全額退休福利領取年齡是 66 歲。

若您在 1955 年至 1960 年間出生,全額退休福利領取年齡逐漸提高至 67 歲。

對於 1960 年或以後出生的人,全額退休福利在 67 歲時支付。

配偶福利也将在生日后开始生效。

社会局希望福利领取人在该生日前3个月就提出申请。

70½ 岁

国税局规定在你满70岁半这年为“退休账户供额(required minimum distribution RMD) 第一年”。要求你开始从投资于退休账户的钱开始提出来,不得低法定的比例。第一回,你必须在次年4月底以前完成。其后,你须于每年年底前提出该年的份额。

如果你第一回RMD就延迟至70岁半的隔年4月份才完成,同年年底你须再提第二个RMD份额。

https://www.transamerica.com/media/rmd-reference-guide_tcm145-100878.pdf

https://www.transamerica.com/media/advanced-markets-new-year-checklist_tcm145-100880.pdf

留意,若您在達到全額退休年齡之前退休,福利將有所扣減。

保存你的财产

退休过程分两个阶段

- 积存阶段- 根据你财务规划有纪律地投资,增强家底

- 支出阶段 –动用上阶段存下来的老本来过自己想过的日子或其他必要的开销。

*注意

没有上班工作,量入为出要有好的计划。尤其是现代人寿命都比前人长。 许多人都在退休后又活了20-30年,甚至更久。

从新检讨你的资产配置

就个人情况,跟你的财务顾问讨论你的投资策略和资产配置。考虑到还有好几年要过,是否应採保守型投资组合,买长期成长类的资产?

编实际的预算,节约开销

仔细列出退休时所有的费用,无论是固定的。变动的, 旅行休闲,医疗,慈善贡献,礼物赠与。。等等。

留意所有的收入来源

除了退休积蓄,要计入社会安全福利金和工作单位提供的退休年金。

详细读读:https://www.ssa.gov/pubs/CH-05-10035.pdf。

开始自己的生意或打非全职工

越来越多的退休人士于退休后继续工作。如此你的老本就不会于退休后被动用,还可被继续用来帮你投资生财。

考虑长期看护保险

一个突然短期的疗养院休养就会消耗掉你大量的储蓄。长期看护照料的费用是非常昂贵的。要使你的投资储蓄仍能持续帮你稳定地产生稳定收入,你需要考虑长期看护保险。

勿忘税务

退休收入仍可能要缴税,要找资料和专家咨询。

仍有医疗保险吗?留意它保的内容符合你的需要。

要为身后事做安排

即将退休

退休在即

– 希望达到的目标: 钱要够用,身体要健康,不要出意外影响这些生活品质。不要失去独立, 不要造成别人负担。

眼看着就要退休了, 不管你喜不喜欢这一事实。你可能要补上储蓄投资不足的钱,或者注意预算改变退休后生活的方式。

你开始要定期做身体检查,知道自己身体的毛病,家族病史。与医生一起评估自己是否有长期病的风险,考虑买额外的健康或看照保险(Medicare 不支付长期的费用)。

至今你一直有为退休做了储蓄。但现在你得严肃地算一下你退休时真正可以用的钱有多少;又可以用多久。

合计一下你所有的可能退休收入,包含从工作上得来的退休金,个人的退休账户,社会安全保险金等等。

在美國領取社會安全福利/養老金(Social Security)

你可以下载 “退休生活预算表 Retirement Readiness Worksheet", 做一较精确的估算。

此时要特别注意考虑下列事情

在退休账户里将投资限额存放到最大额度

美国政府鼓励纳税人设立退休账户,让其有节税或延后缴税的好处,但同时也规定了每年可以存放进去的最高额度。在2018年,个人退休账户(IRAs)的上限额度是$5500, 50岁以上则增加为$6500。 公司提供的退休计划(如: 401K)是每人每年 $18,500, 50岁以上可增为$24,500。

如有相关问题,还有配偶收入是否影响退休金的节税额度,可查IRS 国税局的相关网页或本网站里的相关文章。

从公司的账户转出到何种退休账户?

不同类型退休账户有不同的节税功能。从公司退休时必须从公司的账户转出到何种退休账户?传统IRA 或者 Roth IRA? 这些处置有长远的效应,最好找专家讨论。

终生收入保障

如果你预期社会保险金不够支付你退休生活的开销,你又喜欢有固定收入。 你可以考虑买年金保险。于退休前买年金,可于你退休后领取固定的收入。

保险公司提供各种各样的储蓄及投资方案来保障你未来的收入。请阅读本网站里的相关文章。

我们很乐意解答退休时可能会面临的疑难问题。帮你做退休规划,计算领取申请社会安全保障金的最佳时间点,探讨是否需要额外的各种医疗保险来保障日后的生活品质和想传给子孙的财产。

相关文章

在美國領取社會安全福利/養老金(Social Security)

https://www.transamerica.com/media/avoid-penalty-flags_tcm145-104974.pdf

https://www.transamerica.com/media/field-guide-to-social-security_tcm145-100709.pdf

人生中场

检讨调整财务预算因应新环境,开始做适当的运动,买适当的保险来保护家人和财产。并为下10年及更远未来的退休生活开始准备。

没401(K)账户?没问题。

假如你没持有雇主设立的401K退休账户,你可以赶快设立IRA(个人退休账户),来达到节税的目标。依2018年来讲, 你可以放$5500; 超过50岁的话,可以放$6500.

保护你的家庭,在他们最需要你的时候

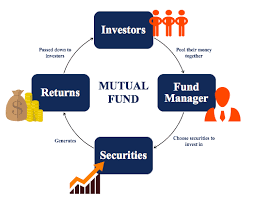

买共同基金来应付中期需求

风险承受度

社会新人

财务专家建议年轻人做好下列几点:

- 开始做预算,养成良好的财务纪律

- 从薪水中,自动划拨款项到退休账户

- 充分利用IRA 账户

- 防范未然,准备适当的紧急备用金

- 买适当的保险,保护好既有的财产, 不让意外拖累到你

遗产规划

13 Estate Planning Mistakes You Don’t Want to Make

Many people make the mistake of thinking that estate planning consists of drawing up a will. That is like saying a tire is the equivalent of an automobile, Here are some of the more common estate planning mistakes people make.

Having No Plan

The most common mistake is having no estate plan at all. For most people this is due to procrastination. For others the thought of dealing with end-of-life issues is just too unpleasant to consider. One would hope that knowing you are planning for your own health and well-being—not to mention providing an organized and orderly inheritance for your loved ones—is motivation enough to overcome any hesitation you may have.

Not Seeking Professional Advice

You can research, organize and make decisions about much of your estate plan, but you can’t do it all yourself. For example, an estate planning professional can help you choose between a will and a revocable living trust. And that’s only the start. There are multiple parts to an estate plan, and help from a pro is the only way to be sure you haven’t left anything out.

Choosing the Wrong Executor or Trustee

Many people want to name a family member or trusted friend as their executor or trustee, but this isn’t always the best idea. In many cases, especially if there is any chance for disagreement among family members, a more objective third party might make more sense. It could even be better to hire a professional as trustee. It will cost money, but may avoid painful family squabbles.

Selecting Co-Trustees

Some people choose co-executors or co-trustees as a way to avoid conflict or give honorary status to someone they feel they might otherwise offend. However, even if the two people you choose agree 99 percent of the time, that final 1 percent can lead to years of legal battles and is not worth the trouble. Pick one person and stick with the choice.

Ignoring Sibling Conflict

Chances are if your children don’t get along now, things won’t get better after you are gone. Sibling conflict is a fact of life in many families. Preparing for it as part of estate planning only makes sense. The best way to do this is to communicate ahead of time so there are no surprises.

Giving Too Soon

If you establish a trust when your children are small, you may assume that by the time they are young adults they will be responsible enough to handle the money and property they inherit. Unfortunately, there’s more than a chance you may be wrong. It might be better to delay the inheritance until the children are older. Another approach is to give your trustee more discretion in deciding when they receive it.

Failure to Address Healthcare

A living will specifies the kind of medical care you do or do not want to receive if you are close to death. A durable power of attorney (sometimes called a medical power of attorney) designates someone to make decisions about your finances and healthcare. A living trust can also address these issues. On your Health Insurance Portability and Accountability Act (or HIPAA) form, you should list anyone with whom your doctors can discuss your medical condition and treatment.

https://www.rothira.com/estate-planning-mistakes

主动性vs 被动性投资

Whenever there’s a discussion about active or passive investing, it can pretty quickly turn into a heated debate because investors and wealth managers tend to strongly favor one strategy over the other.

Understanding the Difference

If you’re a passive investor, you invest for the long haul. Passive investors limit the amount of buying and selling within their portfolios, making this a very cost-effective way to invest. The strategy requires a buy-and-hold mentality. That means resisting the temptation to react or anticipate the stock market’s every next move.

The prime example of a passive approach is to buy an index fund that follows one of the major indices like the S&P 500 or Dow Jones. Whenever these indices switch up their constituents, the index funds that follow them automatically switch up their holdings by selling the stock that’s leaving and buying the stock that’s becoming part of the index. This is why it’s such a big deal when a company becomes big enough to be included in one of the major indices: It guarantees that the stock will become a core holding in thousands of major funds.

When you own tiny pieces of thousands of stocks, you earn your returns simply by participating in the upward trajectory of corporate profits over time via the overall stock market. Successful passive investors keep their eye on the prize and ignore short-term setbacks – even sharp downturns.

Active investing, as its name implies, takes a hands-on approach and requires that someone act in the role of portfolio manager. The goal of active money management is to beat the stock market’s average returns and take full advantage of short-term price fluctuations. It involves a much deeper analysis and the expertise to know when to pivot into or out of a particular stock, bond or any asset. A portfolio manager usually oversees a team of analysts who look at qualitative and quantitative factors, then gaze into their crystal balls to try to determine where and when that price will change.

Active investing requires confidence that whoever’s investing the portfolio will know exactly the right time to buy or sell. Successful active investment management requires being right more often than wrong.

Which Strategy Makes You More

So which of these strategies makes investors more money? You’d think a professional money manager’s capabilities would trump a basic index fund. But they don’t. If we look at superficial performance results, passive investing works best for most investors. Study after study (over decades) shows disappointing results for the active managers. In fact, only a small percentage of actively managed mutual funds ever do better than passive index funds. But all this evidence to show passive beats active investing may be oversimplifying something much more complex because active and passive strategies are just two sides of the same coin. Both exist for a reason and many pros blend these strategies.

A great example is the hedge fund industry. Hedge funds managers are known for their intense sensitivity to the slightest changes in asset prices. Typically hedge funds avoid mainstream investments, yet these same hedge fund managers actually invested about $50 billion in index funds last year according to research firm Symmetric. Ten years ago, hedge funds only held $12 billion in passive funds. Clearly, there are good reasons why even the most aggressive active asset managers opt to use passive investments. (For more, see A Statistical Look at Passive vs. Active Management.)

Strengths and Weaknesses

In their Investment Strategies and Portfolio Management program, Wharton faculty teaches about the strengths and weaknesses of passive and active investing.

Passive Investing

Some of the key benefits of passive investing are:

Ultra-low fees – There's nobody picking stocks, so oversight is much less expensive. Passive funds simply follow the index they use as their benchmark.

Transparency – It's always clear which assets are in an index fund.

Tax efficiency – Their buy-and-hold strategy doesn't typically result in a massive capital gains tax for the year.

Proponents of active investing would say that passive strategies have these weaknesses:

Too limited – Passive funds are limited to a specific index or predetermined set of investments with little to no variance; thus, investors are locked into those holdings, no matter what happens in the market.

Small returns – By definition, passive funds will pretty much never beat the market, even during times of turmoil, as their core holdings are locked in to track the market. Sometimes, a passive fund may beat the market by a little, but it will never post the big returns active managers crave unless the market itself booms. Active managers, on the other hand, can bring bigger rewards (see below), although those rewards come with greater risk as well.

Active Investing

Advantages to active investing, according to Wharton:

Flexibility – Active managers aren't required to follow a specific index. They can buy those "diamond in the rough" stocks they believe they've found.

Hedging – Active managers can also hedge their bets using various techniques such as short sales or put options, and they're able to exit specific stocks or sectors when the risks become too big. Passive managers are stuck with the stocks the index they track holds, regardless of how they are doing.

Tax management – Even though this strategy could trigger a capital gains tax, advisors can tailor tax management strategies to individual investors, such as by selling investments that are losing money to offset the taxes on the big winners.

But active strategies have these shortcomings:

Very expensive –Thomson Reuters Lipper pegs the average expense ratio at 1.4% for an actively managed equity fund, compared to only 0.6% for the average passive equity fund. Fees are higher because all that active buying and selling triggers transaction costs, not to mention that you're paying the salaries of the analyst team researching equity picks. All those fees over decades of investing can kill returns.

Active risk – Active managers are free to buy any investment they think would bring high returns, which is great when the analysts are right but terrible when they're wrong.

Making Strategic Choices

Many investment advisors believe the best strategy is a blend of active and passive styles. For example, Dan Johnson is a fee-only advisor in Ohio. His clients tend to want to avoid the wild swings in stock prices and they seem ideally suited for index funds.

He favors passive indexing but explains, "The passive versus active management doesn’t have to be an either/or choice for advisors. Combining the two can further diversify a portfolio and actually help manage overall risk."

He says for clients who have large cash positions, he actively looks for opportunities to invest in ETFs just after the market has pulled back. For retired clients who care most about income, he may actively choose specific stocks for dividend growth while still maintaining a buy-and-hold mentality.

Andrew Nigrelli, a Boston-area wealth advisor and manager, agrees. He takes a goals-based approach to financial planning. He mainly relies on long-term passive investment indexing strategies rather than picking individual stocks and strongly advocates passive investing, yet he also believes it isn’t just returns that matter, but risk-adjusted returns.

"Controlling the amount of money [that] goes into certain sectors or even specific companies when conditions are changing quickly can actually protect the client."

For most people, there’s a time and a place for both active and passive investing over a lifetime of saving for major milestones like retirement. More advisors wind up using a combination of the two strategies – despite the grief the two sides give each other over their strategies.

Read more: Active vs. Passive Investing | Investopedia https://www.investopedia.com/news/active-vs-passive-investing/#ixzz514qMTQQl

新時代的理財顧問

将要设立或已经有退休账户IRAs或401K的人要注意了。

為保護退休計劃投資人,美國勞工部訂立了“退休金賬戶管理法 - 信託原則”(DOL Fiduciary Rule)。防止証券经纪為賺佣金而誤導投資人買差勁產品。

該法要求:如理财专员因建議你用退休账户来买某金融产品以赚取供应商的佣金時,交易前他须得到你簽名的BICE同意書(Best Interest Contract Exemption),其中须清楚陳述兩項事:(a)建議此一產品的理由; (b)他從此筆交易中从供应商賺得多少钱, 否则就屬違法。因为此时他的身份是供应商的经纪(agent)立场是偏向供应商,而不是你。

受影響的“退休金賬戶”指的是:有從國稅局獲得递沿纳稅(tax-deferred)好處的賬戶。如:401K,403b,SEP,簡單IRA,羅斯IRA,IRA,固定型福利計劃(defined-benefit plan)。

如果你想找立场不会偏向供应商的理财专员,你就应找 投資顧問(RIA, registered investment adviser)。投資顧問向你收取諮詢費(固用定費率或固定金額),除此RIA不得從供應商賺取佣金或任何形式的酬勞。

证券经纪(agent)与投资顾问(RIA)的资格牌照不同。如果你想用投资顾问(RIA, Registered Investment Advisor)的服务, 你需找有证券证照S-65 的顾问签约。 证券经纪(agent)的证照是S--6.

RIA 與agent 的收费方式不同。前者是买方的代表,買方自己付钱买服务。後者是賣家的代理,其服務費由卖方付。

*如有人声称“免費管理”帮你推荐或管理投資退休金賬戶, 极有可能他就是待表卖家的经纪。

想找RIA(註冊投資顧問)或Agent(证券基金经纪)?請聯繫我們。

理财服务

专为您量身定制的投资计划

我们与专业的顾问团队合作,打造出符合你独特需要的投资方案

省去你个人投资时研究市场时间与精力。由我们专业团队掌握市场脉动,帮你操作。

面对面的辅助你关于投资及退休账户方面的问题。

投资理财平台

专业化的个人服务外, 我们用最先进的投资平台来建立合你个人需求的投资组合。让你以低额的投资就享用通常只给富人使用的工具。在这平台里,有多个知名投资机构及他们精心设计出来的投资模组让你选择。

在此你可以放心地用既有的钱去赚更多的钱

这平台有不同特色的投资目标:

- 全球投资,寻求高回报但规避风险集中的地区

- 资产配置多角化

- 各式成长型的投资策略

- 保守低风险的组合

- 节税为主的投资组合

我们让你将众多的投资组合形成多条的策略目标,集合在一个平台,一个账户下管理。合并报表让你很容易可以掌握你的投资情形。同时帮你依定期做账户间的金额调整。使其达到理想的比重。资本利得自动地被再投资回户头里。

投资咨询顾问 Q&A

投资顾问能预测市场走向如何?知道明天的股价会上扬吗?

Vanguard 资金管理部总裁说:没有人能确定未来的市场走向。投资人应该把心思放在可控制的因素上

你如何能帮我赚钱?你不是有钱人,怎能帮助我投资?

我帮你建立合适的投资组合,找可信赖的知名投资公司帮你操作。