Optimax provides quality HD video systems and modern IP phone systems。

Optimax systems have been installed in homes, banks, retail stores, hospitals, and restaurants. We minimize our operation costs and pass the savings to you. We guarantee the lowest price on all our services, please call for free estimate.

Please feel free to contact us. Monday - Friday: 7am - 5 pm Pacific Standard Time.

Optimax Enterprise Inc.

9436 La Rosa Dr. Temple City, CA 91780

Tel: 626-297-1344; 626-380-2328

1 minute reading time

(83 words)

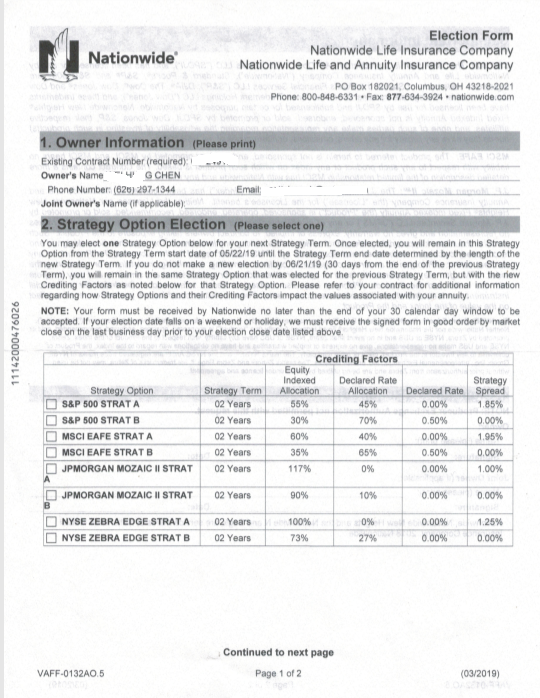

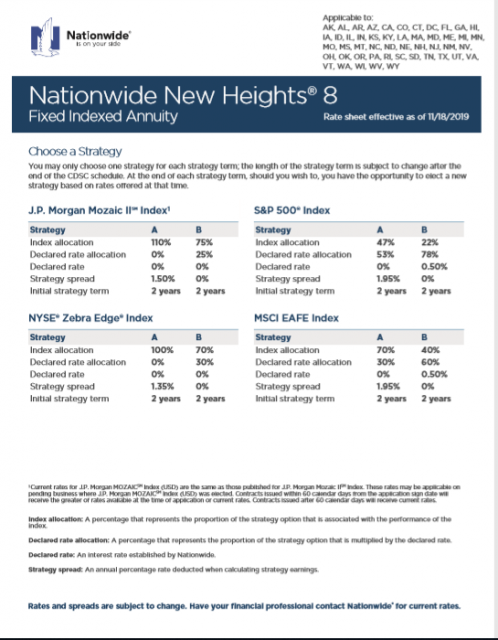

Nationwide Annuity調降年金利息

最近爲了刺激經濟景氣, 美國聯儲會調降利率;並可能將維持這種低利水平很久一段時間。 各保險公司將紛紛調低其年金和儲蓄型壽險的計息利率。Nationwide 的 New Heights 8 Aunnity(年金)也藉由計算公式的改變而調降了計息的利率。

由左邊兩張計息參數(crediting factors)的改變,就可比較得知。由investing.com 的得知, 11/24/2017-11/22-2019, 過去兩年S&P 500 指數上漲了19.5%。 用這個數值來看新舊公式可導致的差異。

S&P500 STRAT A 新舊的計算公式相比:

Equity Indexed Allocation 由55% 降爲47%,

Declared Rate Allocation 由45% 升爲53%

Declared Rate 仍舊爲 0%

Strategy Spread 由1.85% 升爲1.95%。

根據舊公式投資人可從保險公司賺得的回報率:19.5%*55%-1.85%= 8.875%

新公式下只能賺得: 19.5%*47%-1.95%= 7.215%

兩者比較,新公式使投保人的獲利能力下降了: 1.66%

比較S&P 500 STRAT B的新舊公式

Equity Indexed Allocation 由30% 降爲22%,

Declared Rate Allocation 由70% 升爲78%

Declared Rate 仍舊爲 0.5%

Strategy Spread 爲0%

Equity Indexed Allocation 由55% 降爲47%,

Declared Rate Allocation 由45% 升爲53%

Declared Rate 仍舊爲 0%

Strategy Spread 由1.85% 升爲1.95%。

根據舊公式投資人可從保險公司賺得的回報率:19.5%*55%-1.85%= 8.875%

新公式下只能賺得: 19.5%*47%-1.95%= 7.215%

兩者比較,新公式使投保人的獲利能力下降了: 1.66%

比較S&P 500 STRAT B的新舊公式

Equity Indexed Allocation 由30% 降爲22%,

Declared Rate Allocation 由70% 升爲78%

Declared Rate 仍舊爲 0.5%

Strategy Spread 爲0%

舊公式下的獲利率:

(19.5%*30%)+(19.5%*70%*0.5%)=5.85%+0.068%=5.92%

新公式下的獲利率

(19.5%*22%)+ (19.5%*78%*0.5%)=4.29%+0.076%=4.37%

兩者比較,新的公式使投保人的獲利率下降了: 1.55%

(19.5%*30%)+(19.5%*70%*0.5%)=5.85%+0.068%=5.92%

新公式下的獲利率

(19.5%*22%)+ (19.5%*78%*0.5%)=4.29%+0.076%=4.37%

兩者比較,新的公式使投保人的獲利率下降了: 1.55%

Related Posts

Comments

No comments made yet. Be the first to submit a comment